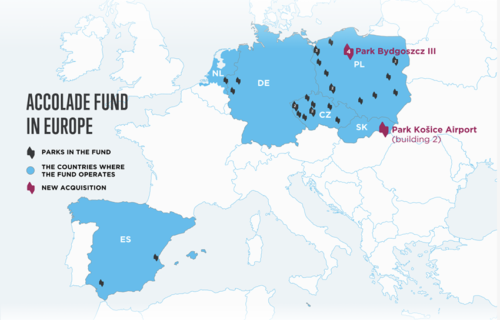

Accolade Fund has significantly bolstered its portfolio by acquiring two new buildings in major industrial parks located in Poland and Slovakia. These strategic investments, amounting to nearly EUR 53 million, have extended the Fund’s partnerships with a diverse group of nine tenants from various sectors. However, the Fund also saw the departure of three tenants in Poland, a development attributed to their evolving space requirements. Despite these changes, Accolade views the departures as a natural progression, offering new opportunities to profitably lease the vacated spaces within its portfolio.

Key Acquisition in Slovakia: Park Košice Airport

One of the most notable acquisitions in recent months is the building at Park Košice Airport in eastern Slovakia. This facility is on track to achieve the prestigious BREEAM “Excellent” environmental certification, underlining its commitment to sustainability. The park’s prime location, near an international airport and major transport routes to Hungary, Poland, and Ukraine, coupled with its proximity to three universities, makes it a highly strategic and attractive site.

The building at Park Košice Airport has already secured five tenants, who have leased a total of 20,000 square meters of space. Notably, three of these tenants—GreenPharm, ViaPharma, and Siemens Healthineers—are from the medical and pharmaceutical sectors. Siemens Healthineers, for instance, has relocated its EMEA production operations from Asia to this modern Slovak facility, focusing on the sophisticated manufacturing of ultrasound systems. The other two tenants, DB Schenker and Hellmann Worldwide Logistics, are leading logistics companies, further enhancing the park’s operational diversity.

New Tenants in Slovakia:

• ViaPharma (Healthcare and Pharmacy): Specializes in the development, production, and distribution of medicinal products. (GLA: 7,658 m²)

• Hellmann Worldwide Logistics (Logistics and Supply Chain Management): Provides global freight and supply chain services. (GLA: 3,218 m²)

• Siemens Healthineers (Industry, Technology, and Engineering): Focuses on the development and manufacturing of medical equipment. (GLA: 3,509 m²)

• GreenPharm (Healthcare and Wellness): Produces and distributes natural health and wellness products. (GLA: 3,430 m²)

• DB Schenker (Logistics and Supply Chain Management): Specializes in transportation and warehousing services. (GLA: 2,531 m²)

Expansion in Poland: Park Bydgoszcz III

Accolade Fund has also expanded its presence in Poland by acquiring the Park Bydgoszcz III industrial park, part of the larger Bydgoszcz Industrial and Technological Park. This latest addition strengthens Accolade’s position as one of the region’s largest investors, capitalizing on Bydgoszcz’s rich industrial heritage. The park, now home to four tenants, covers significant ground with the largest tenant, Reconext, occupying 29,000 square meters for its electronics operations.

Other new tenants in Park Bydgoszcz III include Garden Flora, which specializes in gardening and retail, and Quiosque, a fashion brand under Grupa Kapitałowa Immobile S.A., a major Warsaw Stock Exchange-listed company active across various sectors. Additionally, Qobalt, a logistics company focusing on refurbishing and repairing parts for Nokia, has leased almost 4,000 square meters.

New Tenants in Poland:

• Reconext (Technology and Electronics Service): Provides lifecycle care solutions for electronic devices. (GLA: 29,386 m²)

• Qobalt (Logistics and Supply Chain Management): Specializes in circular supply chain services, particularly for Nokia. (GLA: 3,817 m²)

• Garden Flora (Gardening and Retail): Cultivates and sells ornamental plants and garden supplies. (GLA: 7,369 m²)

• Quiosque (Fashion and Retail): Offers women’s clothing and accessories. (GLA: 6,041 m²)

In the coming weeks, Accolade Fund plans to release a newsletter featuring a quarterly review and detailed results, accompanied by a commentary from Milan Kratina. The Fund remains committed to delivering strong performance and looks forward to continued success in its expanding portfolio.