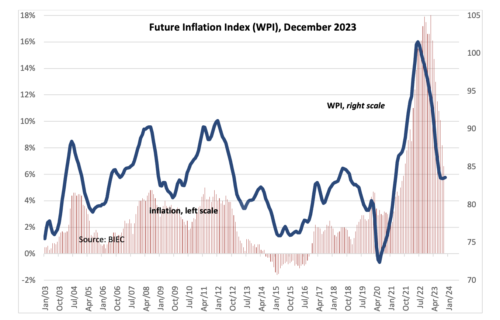

The Future Inflation Index (WPI), which forecasts several months in advance the direction of changes in consumer prices in December 2023, has not changed much. The deceleration of the index’s decline and its oscillation around the same value has been observed for three months. Pro-inflationary tendencies intensify mainly on the side of inflation expectations expressed by consumers, and by representatives of manufacturing companies. Both groups of respondents expect inflation to rise in the coming months.

An intensification of inflation expectations on the part of representatives of the manufacturing industry is being observed for the third month in a row. While in August this year, the advantage of entrepreneurs planning to raise their prices in the near future over the percentage of companies planning to lower them reached only 3 percentage points, in the November survey this year, this advantage increased to nearly 11 points. What is more, sentiment towards raising prices dominates across all size groups, and among the largest companies with more than 250 employees, sentiment towards prices has changed dramatically in the last month, from a dominant tendency to lower prices to a tendency to raise them. This phenomenon is worrying from the point of view of the rate of price increases in the economy as a whole, as large companies are generally in a much better position to keep prices unchanged and realise planned profits than small companies, where the share of fixed costs is much higher. Decisions to raise prices in an environment of limited economic growth are usually taken when companies anticipate a significant increase in costs, have limited competition and/or expect an imminent recovery in demand. One, of these factors arguably underlies the planned price increases. These are labour costs, over which entrepreneurs have very limited influence. These, in turn, have been rising steadily at a rate well above inflation for at least two years. The increasing shortage of workers in the domestic labour market and the ongoing policy of raising the minimum wage have contributed to this. In the coming year 2024, the minimum wage will again increase by leaps and bounds – in January and July 2024. The increase in the minimum wage is not only associated with higher costs for the wage itself and the associated higher amounts of contributions paid, but also results in a commensurate increase in benefits related to severance pay, compensation, standby payments, night work, public holidays, etc. Some experts estimate that employers’ costs will increase by 20 per cent in 2024 alone as a result of minimum wage increases, and by 40 per cent in 2023 and 2024 combined. A higher minimum wage forces increases for other workers, granted the faster and in the higher amount the greater the labour market shortages. The higher cost of maintaining jobs is arguably one of the more significant reasons for the intensification of inflationary expectations on the part of employers.

For the third month in a row, inflation expectations on the part of household representatives are intensifying. In the past month alone, the percentage of those believing that prices will rise in the coming months has risen from 75% in the October survey to 82% in the November survey. It is a rare situation where the trend of consumer inflation expectations diverges from the trend of the officially reported rate of consumer price growth. Consumer inflationary expectations generally follow the annual rate of CPI growth. Heightened consumer concerns about price stability may stem from uncertainty about leaving some price regulation mechanisms in place, such as reduced VAT rates on food, or a freeze on household energy prices.

The IMF commodity price index in November fell by a further 2% from the previous month’s quotations and by more than 14% from a year ago. Reductions affected most industrial raw materials, while some food raw materials rose slightly.

Source: BIEC