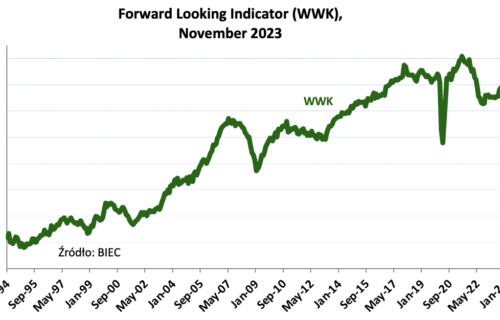

The Economic Outlook Indicator (WWK), which provides advance information on future trends in the economy, rose for the second consecutive month in November. The magnitude of this increase was considerably weaker than a month ago, when the indicator rose by 2.6 points, while it is now up by just 0.8 points. Nevertheless, the improvement in the WWK is now in its fourth consecutive month, giving hope for an acceleration in economic growth in the coming months. While the previous month’s increase in the index was mainly due to a significant acceleration in the money supply and an increase in household credit debt, it is now difficult to identify a single dominant factor. There has been an accumulation of small positive developments in most components. At the same time, they indicate that the expected increase in the economy’s activity will be based mainly on consumption, and this will not make it any easier to combat persistently high inflation.

The rate of inflow of new orders at manufacturing companies did not change significantly in November. There was even a slight decline in orders from foreign contractors. This may be related to the protracted slowdown in the German economy, which is still our largest international trade partner. By industry, demand for food and non-durable consumer goods is recovering fastest. On a much smaller scale, demand for durable consumer goods is growing. In the group of companies producing capital and intermediate goods, we continue to observe a deepening decline in orders and no sign of an imminent recovery in demand for such goods.

From the point of view of the development of production volumes, a positive signal is the deceleration of the tendency for excessive unsold finished goods production to be deposited in companies’ warehouses. This is usually a signal of a resurgence in demand, which usually translates into an increase in industrial production in the following months. For the time being, however, it is difficult to take this signal unequivocally positively for at least two reasons. Firstly, the decline in inventories in recent months has been small compared to the scale of growth seen throughout 2022 and the first half of 2023. Secondly, the last 2-3 months of each calendar year, production and stock levels are strongly distorted by the seasonal factor associated with the holidays, when producers increase production and fill warehouses. Thus, for the time being, it is too early to make a clear interpretation of the recently observed trends in stock level changes.

Companies are signalling a slight improvement in their financial situation. The data come from the November survey of the Central Statistical Office (CSO), which does not yet include data based on company financial statements covering the third quarter of this year. While the quantitative surveys indicate a continued deterioration of the financial situation both year-on-year and quarter-on-quarter, with a particular collapse in the third quarter of this year, the business climate surveys indicate that since August this year the state of finances in companies has been improving slowly but steadily. The stabilisation of raw material prices on global markets, the strengthening of the zloty and the consistent cost rationalisation policy pursued in the private sector have probably contributed to the improvement in these assessments. These measures are likely to translate into a slight improvement in corporate finances in the quantitative statistics covering the last quarter of this year.

Author: Maria Drozdowicz – www.biec.org