After a year of declines, property prices in the Czech Republic are turning back to growth and in many places at such a pace that they are erasing the previous “cheapening”. Households in Prague, but also in the Central Bohemian Region, are having to pay extra for housing again. By contrast, prices of flats continue to fall in South Moravia, where interest has shifted towards family houses. Those looking for rental housing should hurry up – prices are rising here too, but they could jump even more in the coming months.

“We are now in a continuing phase of moderate optimism. It turns out that there is still money in the property market – falling prices and spring sales have attracted not only households but also institutional investors who have started to buy and sell,” mentions Hendrik Meyer, head of the EHS Group and Bezrealitka. “On the other hand, it is impossible to ignore the widening scissors between the good properties and the others, which, on the other hand, continue to lose value.”

Prague apartments are becoming more expensive with a small number on the market, prices have returned to the same level as a year ago.

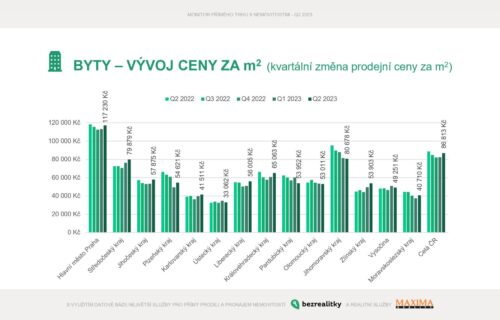

Prague prices returned to growth with the start of summer, erasing their year-long decline with the price of an older apartment exceeding 117,000 per square meter. The blame lies on stronger demand, supported by, among other things, renewed interest in mortgages and continued tight supply. It is still the case that sales were mainly driven by properties whose owners were pressured by time – for example, due to inheritance proceedings, financial situation or the purchase of another property.

Hidden discounts by developers may also have played a minor role, leading to households exchanging an older flat for a new-build home, while other properties came from people who were unable to secure mortgage repayments after refinancing.

Owners of smaller flats, where demand has risen by leaps and bounds, are benefiting more from the situation, whereas in the case of atypical properties or larger flats before renovation, which are sold under time pressure, more substantial concessions are in most cases necessary.

“It is already almost clear that Prague property prices will continue to rise. Although supply continues to outstrip demand, people are still willing to pay extra for better properties that have fallen in price. Unless major financial uncertainty comes to the market, there is not much reason for the market to fall further in Prague at the moment,” Hendrik Meyer believes. “For several quarters in a row it appears that owners prefer to hold off selling rather than accept current prices. From my point of view, by the end of the year we may reach the level of CZK 125,000 per square metre in the offer prices of Prague secondhand flats, i.e. roughly the level of Prague’s new construction in 2021.”

Central Bohemian flats just below historic milestone, good houses sold out.

The second quarter also confirmed the growing links between Prague and the so-called metropolitan ring – a broad catchment area in the Central Bohemian Region, which already includes cities such as Kladno, Beroun, Benešov, Příbram, Kolín, Mladá Boleslav and Mělník. The aforementioned low variety of properties on offer in Prague and rising prices in the capital make Central Bohemia an increasingly welcome location. A record number of households became “New Central Bohemians” again in the second quarter.

Of course, the high demand for Central Bohemian real estate did not go unanswered and prices soared to new highs. For family houses they increased to almost 65 thousand per square metre, for flats to almost 80 thousand per square metre. The demand was mainly for reconstructed prefabricated flats, but the segment of townhouses also strengthened, which is gaining a premium character in many localities thanks to the growing number of complete reconstructions of entire buildings.

“The Central Bohemia region is now facing a major emancipation. If city leaders can respond adequately to the situation, new local centres may emerge and the link to the capital will gradually loosen. Everyone could benefit from this, because it means one thing – a young and above-average generation will return to many smaller towns and villages from Prague,” explains Hendrik Meyer. “The key now will be to strengthen transport links in the long term – especially in the form of high-capacity public transport. Distance does not play as much of a role in the choice of location as the speed of access to the centre of Prague.”

South Moravian flats do not pull in the light of cheap houses.

A different story is unfolding in the South Moravian Region. Here, apartment prices have been falling for more than a year and for the first time in the history of measurement their average price is approaching the prices in the already mentioned Central Bohemia Region. At the beginning of the summer, an older apartment sold on average for around CZK 80,500 per square metre, which is about 15% less than a year ago at this time. The reasons for this are probably twofold – a lower number of quality flats on offer and the return of South Moravians to family houses.

On the contrary, there is an above-average number of them on offer and they are offered at the best prices in the last 24 months. This is in spite of the rising average price, which is to some extent a statistical fallacy – the prices of quality properties are falling, while those of poor quality are more often than not becoming repeatedly discounted lagers with no prospect of sale (and are therefore not included in the average prices, unlike in previous periods). With the exception of premium locations and real estate, prices have thus fallen in virtually all areas of the Brno metropolitan ring.

“South Moravian areas are traditionally ‘house-builders’ and although flats have been growing in popularity over the last three years, the situation is now reversing again. It comes as something of a surprise that there is also interest in older properties requiring major renovation – this shows that buyers are willing to pay extra for a particular location or house location – for example in the centre of a village,” explains Hendrik Meyer.

According to him, however, in the case of Brno, we can also expect apartment prices to turn to growth again before the end of the year, although it will probably not be as sharp as in other regions.

Investment apartments and returnees.

Other trends worthy of attention include price reversals in some regional cities, represented mainly by Pilsen, České Budějovice and Hradec Králové. Here, after months of declines, prices have turned around and erased the declines of recent months. One of the reasons for this is the growing number of so-called “returnees”, again related to the rising cost of living in the capital. High-quality properties in the central districts of regional cities at unprecedentedly low prices (relative to those in Prague) have tempted many people to return to their home region. This trend is directly linked to the possibility of working from home and indicates the criteria by which some Czech households will choose housing in the future.

“The desire to live in one’s own Bohemia is not leaving. And now that they have the opportunity to shop in their home regions, they are happy to take it. Both for housing and investment. From my point of view, this is actually very good news for the Czech Republic – it gives a clear feedback that the quality of life in and around regional cities is constantly improving and that these cities have a lot to offer,” mentions Hendrik Meyer.

Another trend that has made its way slightly into the average prices is the purchase of investment apartments in towns close to attractive tourist locations – especially in the Jizera Mountains and the Giant Mountains. Very often these are ordinary prefabricated flats, but the owners want to rent them out as holiday apartments.

Rents are growing as expected, the pace is likely to increase.

Prices of rental housing also rose in line with expectations. In Prague, it stabilised just below CZK 340 per square metre, while in the Central Bohemian Region it rose to CZK 248 per square metre. On the other hand, in Brno and the South Moravian Region in general, the statistics recorded stagnation after the spring drop. Overall, however, the growth is well below inflation, reflecting not only the weakening purchasing power of the population, but also the stabilisation of demand.

While this remains high – Bezrealitky has recorded fewer than 30 applicants per apartment in recent months – it is nonetheless constant, helping to harmonise rental prices. However, Meyer said that with the start of the second half of the year, some areas can be expected to see a sharp increase again.

“This could particularly affect the Central Bohemian Region and regional university towns such as Plzeň, Olomouc and Hradec Králové. However, we also expect further significant rental growth in Prague. Owners of apartments and increasingly also of houses will respond to the increased demand, which is usually highest in September. And again they will try to sanitise the rising costs of running the property. By the end of the year, rents could rise again by around ten percent in many places.”