As the latest data from the residential market show, the expected drop in the prices of new apartments has not occurred and most likely will not occur. There is no room for a general reduction in prices due to the large increase in the price of practically all entrances, the insufficient permitting of new apartments and the weakening of the offer due to the postponement of projects. The residential market for new apartments will stagnate this year and next, but will remain stable. We can expect a slight recovery as early as next spring, and a more significant recovery will be brought by cheaper mortgages with interest rates of around 3%, which is expected in 2024. This is according to the market analysis published today by the companies Trigema, Skanska and Central Group.

The latest data show that the prices of new apartments in Prague continued to rise in the third quarter. The average sales price reached CZK 147,884 per sqm, the asking price CZK 154,181 per sqm. This is 17% and 12% more year-on-year. Despite many expectations, the prices of new apartments did not fall, and it is unlikely that a general decline will occur in the following periods. The reason is the rapid growth of practically all costs, most recently energy and building materials, the long-term insufficient number of apartments permitted for construction and the limited supply, which will also be weakened by the postponement of new projects due to uncertainty in the construction market.

The prices of new apartments will therefore most likely stagnate in the coming periods and stabilize at around CZK 145-150 thousand per sqm. However, a slight drop in prices is likely for older apartments. There will therefore be an increase in the difference in prices between new buildings and older apartments, which will more reflect the better quality standard and much lower energy requirements of new buildings compared to older apartments.

“The prices of new apartments in Prague increased by less than a fifth year-on-year, but during this year price stabilization is taking place and since the end of the first quarter of this year, growth has not even exceeded 2%. However, we do not see room for a drop in the prices of new apartments, especially due to the unprecedented rise in prices of key inputs such as building materials, energy prices, and land, and there is also no streamlining of lengthy permitting processes with the aim of regularly supplementing the offer with new projects. The current uncertainty, fears of further cost increases and project postponements, in conjunction with slow permitting, can significantly change the supply and therefore sales prices in the future,” assessed Petr Michálek, chairman of the board of Skanska Residential.

The revival of sales will be brought about by cheaper mortgages.

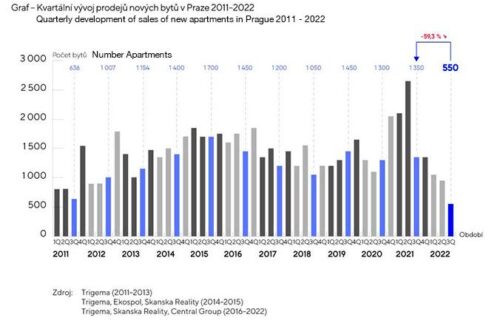

In Prague, 550 new apartments were sold in the third quarter, i.e. 42.1% less than in the previous quarter. So far, 2,550 apartments have been sold since the beginning of the year, which is significantly less than in the same period last year. The large year-on-year difference in sales is also due to the high comparison base, as last year was a record with 7,450 apartments sold. Compared to the long-term average, this is a decrease of roughly one-third.

Sales fell mainly due to significantly fewer available mortgages, which are roughly three times more expensive this year than a year ago, as well as great uncertainty about future economic developments. The demand for new housing is still high, but in the current situation, the purchase decision is postponed until the situation stabilizes again and interest rates fall. A slight recovery in sales should come in the spring of next year after overcoming the winter and adjusting to the current shock. However, a more significant recovery of the market will only come with the return of interest rates to 3%, which could happen in 2024. Until then, the market will stagnate and sales will most likely only be around 3,500 – 4,000 sold apartments per year.

“The decline in sales almost completely follows the curve of the decline in mortgages. The market has indeed stopped, but it is a temporary stop. People who have cash will logically wait for the moment, however, after that they will look for a safe investment to put their savings so that they are not devalued by inflation. And as history shows us – one of the safest commodities is still real estate, when apartment prices have been rising continuously for 20 years,” says Marcel Soural, chairman of the board of the Trigema investment group.

The supply of new apartments will stagnate or decline.

There were 4,700 new apartments available in Prague at the end of the third quarter. This is up 13.3% from the second quarter of this year and up 70.9% from the third quarter of 2021, when supply was at an all-time low.

In the next period, however, a decrease in supply is likely. There is still a large shortage of apartments. From January to August of this year in Prague, only 3,252 apartments received permission. At this rate, only around 5,000 apartments would be permitted, which is only about half of what the capital city needs every year. In addition, due to the worsening economic situation, fewer projects will enter the market.

“Construction costs have increased dramatically. Added to this is significantly more expensive financing, general market uncertainty and a drop in sales. A number of investors will therefore suspend or postpone their projects and will wait to launch them on the market until the situation stabilizes,” concludes Dušan Kunovský, founder and head of Central Group.

Source: Trigema, Skanska and Central Group