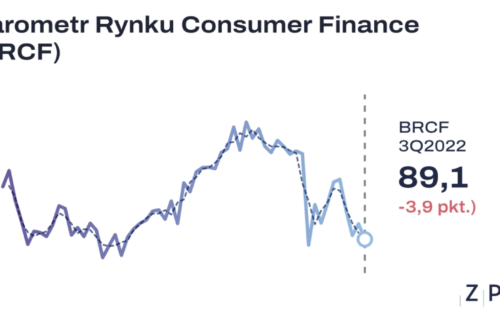

Consumer Finance Market Barometer fell by 3.9pts q / q to 89.1pts. in the third quarter of this year, according to a study of the situation on the consumer finance market of the Union of Financial Companies in Poland (ZPF) and the Institute for Economic Development of the Warsaw School of Economics (IRG SGH). The direction of the BRCF indications, despite the improvement noted in the previous survey, may mean a slowdown in the dynamics of lending in the period of several consecutive months.

The value of the Consumer Finance Market Barometer (BRCF) is 1.5 points above the bottom of the COVID-19 pandemic and 4.7 points more than the historical low 10 years ago (84.4 points). The situation on the consumer finance market is very bad and is in a downward trend, it was reported.

Indications worsened in all four BRCF areas. Once again, very pessimistic assessments of the overall economic situation were recorded. About 75% of households expect the overall economic situation in Poland to worsen in the next 12 months – almost as much as at the peak of the pandemic (80%). For comparison, before the quarter it was 72%, and a year ago only 51%. Fears of unemployment have also increased. About 60% of respondents forecast an increase in the unemployment level, previously it was 55%, and a year before 51%.

Despite pessimistic assessments of the economy as a whole, households assess better the balance of their own budget in the current quarter. About 51% of respondents declare that they have a financial surplus and are able to save from their current income (previously 47%, 56% the year before). However, when it comes to the forecasts of the household’s financial situation, for the fourth time in a row there were more forecasting deterioration. Currently, there are around 62% of them, as compared to 54% previously and 33% a year ago. A smaller percentage of respondents also expect trouble-free service of liabilities (47%), the figure was around 52% before the quarter, and 56% the year before.

“Assessments of the macroeconomic environment have a negative impact on the consumer finance market and work towards a decline in the value of the BRCF. Together, the area of financial position and creditworthiness contributed to the deterioration of the barometer in the current study, and the assessments in this regard are pessimistic compared to the situation from the previous year and before the pandemic,” said Sławomir Dudek from IRG SGH.

The barometer component related to major expenses financed by the loan also deteriorated. The probability of spending on durable goods, the purchase of a car, renovation and purchase of an apartment has decreased. The propensity to use a loan has also dropped, except for spending on car purchases.

“Consumer sentiment in the consumer finance market is in a strong downward trend. The outlook is also not optimistic. We observe a decline in the propensity to spend and lower demand for loans. High inflation and low economic growth may lead to stagflation in Poland, which may be an even more unfavorable situation. than the current one,” summarized the president of ZPF, Marcin Czugan.

Source: ZPF and ISBnews