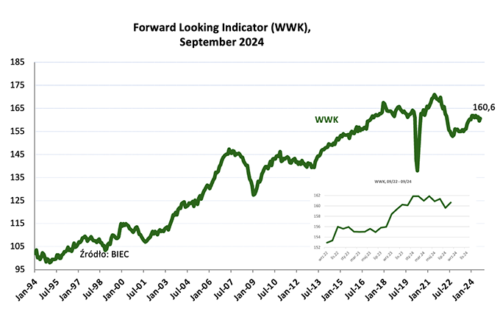

The Forward Looking Indicator (WWK), which tracks trends in the economy, increased by 1 point in September 2024 compared to the previous month. Despite the modest rise, the indicator remains below its last local peak recorded in January of this year.

Domestic demand continues to serve as the primary driver of the economy, compensating for the marked weakening of foreign demand. According to the latest report, this trend is expected to persist, and may even strengthen, as wage growth continues to outpace inflation. Additionally, flood relief efforts are likely to boost household, business, and public sector spending in the medium term.

However, a shift in the structure of economic growth is not anticipated until late 2024 or beyond, when funds from the National Investment Programme (NIP) are set to be deployed to support investment.

The WWK consists of eight components, three of which improved slightly in September, four remained mostly unchanged, and one deteriorated. The factors driving this month’s increase include a slight improvement in the financial situation of manufacturing companies, a reduction in product inventories, and a rise in consumer interest in bank credit.

While the financial situation of companies has shown signs of improvement, a majority of businesses surveyed by the Central Statistical Office (CSO) still report financial difficulties. Some firms appear to have weathered the initial impact of increased costs associated with the minimum wage hike, compensating by raising prices.

Household borrowing saw a 0.5% month-on-month increase, with a nearly 2% rise over the past year. Consumers predominantly opted for cash credit, installment credit, and mortgages, although mortgage lending slowed in August due to pending government decisions on a first-home financing scheme.

Manufacturing companies also significantly reduced their inventories of finished goods in September. This move was aimed at adjusting inventory levels to meet reduced demand, while simultaneously allowing firms to maintain production levels in the coming months, even if demand continues to fall.

However, no significant uptick in new orders was reported, with foreign demand continuing to decline. The largest reductions in orders were noted among companies producing capital and intermediate goods.

In addition, labour productivity in the manufacturing sector has been on a steady decline throughout 2024, falling by a further 3% in August compared to July. This decline underscores the challenges faced by the sector as demand weakens both domestically and internationally.

Source: BIEC