CBRE, has published the results of its extensive Shopping Centre Index analysis, which annually assesses the performance of regional shopping centres over the past year. The main criteria are footfall, achieved turnover, the value of the average basket, rents, and vacancy rates.

The obtained data show that the footfall in regional shopping centres in 2021 remained at similar levels compared to the previous year and the year-round total fell by 27% behind the figures for the pre-covid year of 2019. “Even though the footfall numbers suggest a change in customer behaviour, the trend in turnover shows that it is mainly a different frequency of visits and their planning. This is also confirmed by the year-on-year increase in the average basket by more than 10% to almost CZK 260 per visit to a shopping centre. More positive news is that last year, during the long-lasting lockdown, there was no such significant drop in footfall, which reached up to -70% in 2020. This is one of the reasons why retailers’ annual turnovers fell by more than 25% the year before last. However, last year, from the total turnover point of view, it brought a recovery of almost 15%,” commented Klára Bejblová, Associate Director – Retail Research for the Czech Republic and CEE region at CBRE.

Specialised retail fared best in terms of turnover:

The sector that saw the lowest drop in turnover (by “just” 6%) compared to 2019, was specialised retail. This result significantly affected the categories of goods not subject to sales restrictions. These were mainly the categories of Optics & Pharmacies (+11%) and Health & Beauty (-5%). These were followed by Electronics with a long-running online platform, which maintained one of the lowest drops in both years. While large-scale operators achieved better results in 2020, in 2021 the decline of only 14% compared to 2019 was driven by smaller specialised electronics stores (like iStores, Xiaomi and ETA)

The most significant recovery compared to 2020 was felt by the sectors of Food & Beverage and Services, which together with leisure activities were fundamentally affected by protective measures even after the reopening of operations. Food & Beverage, which was the most dynamically growing segment in the pre-pandemic period, and which recorded an increase in revenues from -35% in 2020 to -17% in 2021 (compared to 2019), was positively influenced mainly by fast food operators. In response to government constraints, they introduced take-out windows and began offering the wider delivery of their refreshments. Restaurants with a drive-in option also achieved very good results.

Despite a considerable recovery, the results of the whole year in the Fashion, Accessories and Sports sectors in 2021 were below a 20% decline compared to 2019. In Fashion, the best results were seen by the offer for Young apparel with a drop of about -10% and Lingerie stores with -17%. Only a slight improvement and a total decrease of almost 40% was recorded by women’s fashion, where CBRE has already registered several brands leaving the Czech market. A significant difference was recorded by the Sports sector when comparing large-format operators (representing an assortment of sports equipment) with smaller shops (with a predominance of sportswear and accessories). For the former, there was an improvement from -28% to -14% compared to 2019, while for the latter it was only from -33% to -27%.

Average rents increased by about 1%:

The vacancy rate of regional shopping centres remained almost unchanged in the year-on-year comparison at 4.4%. Thanks to ongoing government compensation programmes and the interest of shopping centre owners, there was no significant correction of average rents in 2021, which, on the contrary, increased by less than 1% compared to 2020. Nevertheless, taking into account the indexation, which was 3.2% according to the Czech Statistics Office, it follows that the average level of rent of newly-leased premises decreased by more than 8% year-on-year.

The highest and also continuing growth in rents, which increased by 6% year-on-year in 2021 and 11% compared to 2019, was recorded by the electronics sector. It was mainly driven by “step-up” rents (which increase over time) at specialised electronics stores. A very common feature was the optimisation of space and the branch networks in individual operators. The effect of the change in the space had a significant effect on the correction of rents in the Services sector, where the average rental increase was 4% year-on-year, but the average unit size decreased by 4%. On the contrary, in the Household & Furniture sector, the average rental fell by 3%, but the average unit area increased by 8%.

The highest growth dynamics of average rents were once again reported by the smallest units up to 100 m2, by 2.9% (0-50 m2) and 1.9% (50-100 m2) year-on-year. Compared to 2020, there was no decrease in average rents for other size categories above 100 m2, however, the significant decrease caused by repeated restrictions on retail at the end of 2020 affected the rent levels so that the resulting figures in 2021 were still below the level of 2019.

The total retail sales increased in the Covid years. Thanks in part to e-shops:

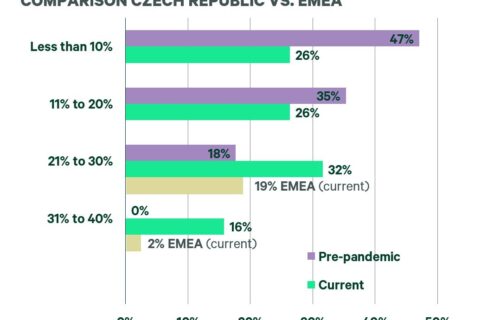

The ever-increasing purchasing power of the population has been largely spent on retail in recent years. Total retail sales increased by 0.1% year-on-year in 2020, while last year by 4.5%. During the lockdowns, however, purchases moved mainly to the online environment. Thanks to this, online increased year-on-year by 27.3% in 2020 and by 15.7% in 2021. This is also illustrated by the current CBRE survey among retailers. While 13% of the brands surveyed generated 21-30% of their total turnover in the online environment in 2019, it is currently 32% of the brands. We can observe an even more noticeable difference at retailers whose e-shop revenues account for 31-40% of their total turnover. Before 2020, none of the companies surveyed had reached such levels, while this year it is already 16%. In this context, there is an interesting comparison with the EMEA region. As part of the CBRE survey, only 19% of retailers reported that they achieved online sales between 21-30% and only 2% of respondents mentioned a share of online sales above 31% of the total turnover. These results illustrate the fact that the e-commerce platform in the Czech Republic has already found its place and has a long tradition. Moreover, with the advent of the pandemic, this trend has intensified.

“The coronavirus pandemic changed the customer behaviour and forced retailers to optimize sales channels, some of them also introduced new channels. For the future, the appropriately set ‘omnichannel’ strategy, combining multiple sales and communication channels, will play a decisive role in business success,” stated Jan Janáček, Head of Retail Sector and Advisory & Transaction Retail at CBRE, commenting on the results of the current survey: “If we assess turnover generated solely in physical stores without online sales, then 56% of retailers are currently at somewhere between 100-75% of their original pre-pandemic level and 12% are even higher than in 2019. It is interesting to compare with the EMEA region, where the return to the pre-Covid condition has taken place noticeably faster. Altogether, 36% of brands generate higher turnover than in 2019 and 40% are between 100 and 75%. Among other things, the significantly higher inflation in the Czech Republic compared to the Eurozone may have an influence.”

Future threats: inflation, disruption of supply chains and wage growth:

The dynamic growth of inflation and the associated reduced purchasing power of customers are perceived by most retailers (92% of respondents) as the most significant threat to sales in the near future. More than 50% of respondents admitted concerns about supply chain disruption, and 36% of the brands were scared of a sharp increase in wage costs and a slower recovery of tourism. A long-term labour shortage remains an equally critical factor for retailers. On the other hand, only 24% of respondents see another wave of Covid-19 as a potential risk (as opposed to the EMEA region, where the vast majority of retailers consider a potential autumn wave of the pandemic to be the biggest risk).

However, despite the aforementioned concerns, retailers are bouncing back after two difficult years, and almost three quarters of respondents even plan to expand and open new branches in the foreseeable future. These are particularly companies from the Sports and Food & Beverage segments. Fashion and Health & Beauty brands are also preparing to expand, but at the same time they expect to close non-profitable stores.