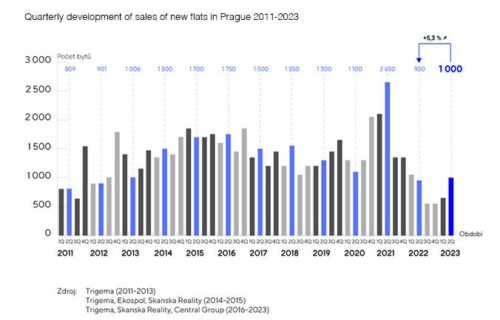

The latest data from the residential market confirm what the mortgage market results already suggested. Interest in new housing in Prague has been growing for two consecutive quarters. In the second quarter, 1,000 new apartments were sold here, half as many as in the first quarter. Prices of new flats have not changed much, nor has the number of flats on offer, which is still roughly half of the metropolis’ long-term need.

In the first half of this year, 1,650 flats were sold, which is 50% more than in the second half of last year, in which a total of 1,100 flats were sold. Moreover, the interest in new apartments continues to grow gradually. While 650 new flats were sold in the first quarter, representing an increase of around 18% compared to the last quarter of 2022, the 1,000 new flats sold in the period from April to June this year represent a nearly 54% quarter-on-quarter growth in demand. On a year-on-year basis, this represents an increase in sales of more than 5%.

The increased demand can be explained by several factors that have influenced the market. First of all, the initial shock and uncertainty about the future development have already subsided. Inflation and interest rates have stopped rising at an unprecedented rate and are gradually starting to fall again. The situation is similar for energy prices. People have already got used to the new situation to some extent. Temporary sales incentives, marketing bonuses and introductory prices with special payment terms in newly launched projects have also had an impact. The mortgage market, which is a connected vessel with the housing market, has also seen a more significant recovery. In normal times, more than half of new flats in Prague are sold on mortgage and with the improvement in the conditions for obtaining loans, some of the previously postponed demand has returned to the market. Further growth in sales can be expected as interest rates gradually fall and mortgage conditions ease.

“We are seeing rising confidence and expectations from households and consumers who believe that the current period is becoming a good time to make large purchases again. While respondents’ views on the suitability of the time to invest are still below the zero threshold, there is a marked improvement in sentiment compared to recent months. The appetite to buy is also growing among large investors, who are responding to reports that we are set for significant global house price growth over the next ten years. According to a study by the ifo Institute and the Institute for Swiss Economic Policy (IWP), the average annual nominal growth rate will be 9%,” comments Marcel Soural, Chairman of Trigema Investment Group.

Prices of new flats continue to remain above CZK 150,000 per m²

During the last period, several projects with introductory prices and special payment terms have come on the market, where significantly lower prices of apartments were conditional on payment of the purchase price in advance. Their influence was also reflected in average prices on the housing market, which fell slightly as a result. The average selling price per m² reached CZK 150,835 (quarter-on-quarter -0.7%, year-on-year +3.5%), while the offering price reached CZK 151,583 per m² (quarter-on-quarter -2.2%, year-on-year -0.3%). However, the prices of new flats continue to remain above CZK 150,000 per m² and a temporary stagnation around this level can be expected in the future. Broad-based price reductions cannot be expected due to the sharp increase in construction costs, especially in the previous two years, and the continued slow pace of new construction permits.

Development of the average price per m² of new flats in Prague 2012-2023

“The development of offer prices of new flats in Prague continues to be accompanied by stability above the level of 150 thousand per m². Nevertheless, one cannot overlook various spring sales promotion activities of sellers, which may have had a unit reduction on final prices. However, the quality of new housing is confirmed when comparing the primary and secondhand markets. The price difference between older and new apartments, which have a significantly higher quality standard, exceeds 20 percent,” said Petr Michálek, Chairman of the Board of Skanska Residential a.s.

The supply of flats is still insufficient and will rather decrease

At the end of June this year, there were 5,500 new flats on offer in Prague, which is almost the same as at the end of the last quarter (down by 50 flats) and about a third more than at the beginning of last summer. However, this is still a value corresponding to the long-term Prague average. At the same time, the metropolis would need at least double the supply.

Faster replenishment of supply has long been hampered mainly by the slow pace of permitting new construction. In the first six months of this year, only 1,917 flats in apartment buildings were permitted in the capital, almost a fifth less than in the same period last year. In April, only 48 flats were permitted in Prague as a whole, and in May only 17 flats. The supply of flats for purchase is also weakened by the growing rental housing market and the persistently complicated situation in the construction industry, where high costs are causing many projects, including residential ones, to be postponed.

“The supply of new housing has long been insufficient due to dysfunctional permitting and is at risk of falling further. This, together with a rise in demand thanks to more affordable mortgages, may lead to a renewed rise in the price of new flats next year. After a slowdown in the second half of last year, sales have already been rising strongly since this spring. This year is the year of marketing bonuses on the housing market, from which buyers can benefit significantly. There will be no more favourable conditions for buying an apartment than this year,” concludes Dušan Kunovský, Chairman of the Board of Central Group.

Source: Results from a market analysis of the development companies Central Group, Skanska Residential and Trigema.