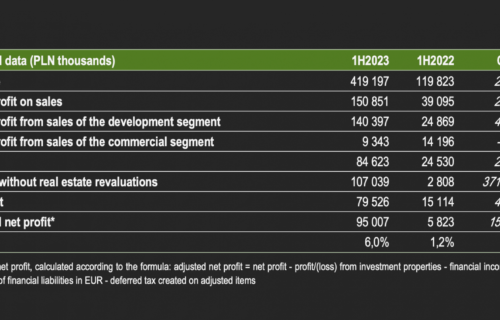

– In H1 2023, Develia Group’s sales revenue amounted to PLN 419.2 million, compared to PLN 119.8 million in the same period last year, a 250% increase.

– The group’s net profit amounted to PLN 79.5 million, compared to PLN 15.1 million net profit in H1 2022, an increase of 426%.

– In the first six months of 2023, the developer sold 1184 units vs. 964 in the same period of 2022, up 23%, and handed over 666 units vs. 206 a year earlier, up 223%.

– At the end of June this year, Develia had PLN 747.4 million in cash and short-term financial assets versus PLN 481.6 million at the end of 2022.

“We performed very well in the first half of the year, recording significant increases compared to last year. It is worth mentioning that, as in 2022, we plan to accumulate handovers at the end of the year, which is due to the schedule of ongoing investments and will have a positive impact on Q4 results. Recent months indicate a continuation of the positive trend in the residential real estate sector. We are currently seeing demand outstripping supply in the market. With the acquisition of Nexity, we are better able to respond to this greater demand, so we have significantly increased our targets for this year. We are aiming to sell 2,500-2,600 units, which is 60-70% more than our February target. We are also increasing the group’s sales potential by systematically expanding our land bank – we plan to carry out further land purchases in the coming months,” says Andrzej Oślizło, Develia’s CEO.

Development activity:

Develia sold 1184 units in the first six months of 2023 under development and preliminary agreements, compared to 964 in the same period last year, an increase of 23%. The Group handed over 666 units, 223% more compared to 206 units a year earlier. In the first half of the year, Develia launched 1,723 units in developments whose construction had begun.

In Q2 2023, the company sold 651 units, up 80% from 361 units in the same period last year. Most apartments found buyers in the projects: Aleje Praskie in Warsaw, Centralna Park in Krakow and Ślężna Vita in Wroclaw. In the period April-June this year. Develia handed over 225 units, mainly in the projects Aleje Praskie in Warsaw, Kaskady Różanki in Wroclaw and Marinus in Gdansk.

In June this year. Develia signed a preliminary agreement to acquire 100% of the Polish subsidiaries of Nexity, a French real estate development company. The €100 million transaction was finalized in July this year. As of the date of the purchase, Nexity had about 1,400 units in Poland at various stages of construction and a land bank of about 2,100 units. The company’s inve-ments are located in Warsaw (about 66% of the units), Krakow (25%) and Poznan (9%). In addition, Nexity has entered into preliminary agreements for the acquisition of land enabling the reali-zation of another approximately 2,300 apartments. After the acquisition of Nexity’s companies, Develia’s land bank amounts to about 10,000 units, with approx. 5700 units.

In early September this year. Develia updated its targets for 2023, increasing the target level of housing sales to 2,500-2,600 units, an increase of 60-70% over expectations from the beginning of the year. The company aims to hand over 2500-2600 units, up from the previous target of 1900-2050 units, or about 30% more. Develia also aims to introduce and start construction of 2,700-2900 units, against a previous target of 1850-2050 units, an increase of about 45%. The updated targets are the result of an improving residential real estate market and Develia’s acquisition of Polish company Nexity.

Commercial operations:

Develia in H1 2023 successfully continued to implement its strategy of divesting non-commercial real estate. In April this year, the company finalized the sale of the Wola Re-tro office building in Warsaw. The buyer is WR Office, owned by an investment fund managed by Adventum Group. The sale price was EUR 69.3 million.

Develia is continuing negotiations for the sale of Arkady Wroclawskie. The company’s goal is to sign a preliminary agreement for the sale of the building by the end of December this year. In March 2023, the management of Arkady Wroclawskie decided to close the Arkady Wroclawskie shopping center. It was influenced by the facility’s lack of profitability due to, among other things, the difficult market sy-tuition caused by the COVID-19 pandemic, rising electricity costs and high inflation. It is estimated that the mall’s operations will be completed in the first half of 2024.

The group’s revenues for H1 2023 amounted to PLN 419.2 million, compared to PLN 119.8 million a year earlier. The group’s net profit amounted to PLN 79.5 million, compared to PLN 15.1 million in the same period last year.

Gross profit on sales from development activities for the first six months of 2023 amounted to PLN 140.4 million on revenues of PLN 398.8 million. Gross profit on sales from rental services amounted to PLN 9.3 million on revenues of PLN 19.3 million.

In June this year, Develia’s shareholders decided that the company would pay a dividend for 2022 of PLN 179 million, or PLN 0.4 per share. The first tranche of the dividend was paid on July 21 (PLN 107.4 million), and the second tranche will go to shareholders on October 13 (PLN 71.6 million). The amount of PLN 117.7 million from the 2022 profit was allocated to reserve capital.

“Thanks to Develia’s very good liquidity situation at the end of the first half of the year, we were prepared to take advantage of market opportunities and acquire the Polish companies of Nexity. It also allows us to flexibly start new investments and increase the scale of operations in line with current management objectives,” says Pawel Ruszczak, Develia’s vice president.

At the end of June 2023. Develia had PLN 747.4 million in cash and short-term financial acts, compared to PLN 481.6 million as of December 31, 2022. At the end of H1 2023, financial liabilities amounted to PLN 531.1 million, compared to PLN 583.9 million at the end of 2022.