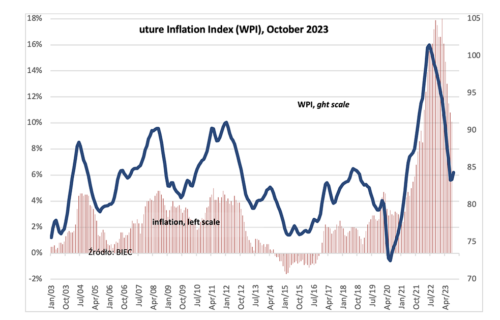

The Future Inflation Index (WPI), which forecasts several months in advance the direction of changes in consumer prices in October 2023, rose for the second consecutive month. The components foreshadowing a renewed rise in inflation have arrived. This group primarily includes the inflation expectations of business representatives and consumers. This demonstrates the lack of faith of fundamental market participants in the effectiveness of the central bank’s monetary policy and its official narrative.

Of the eight components of the index, five acted to increase inflation and three to decrease it.

For the first time in a year, the inflation expectations indexes of consumers and managers of manufacturing companies rose. The intensification of inflation expectations is particularly evident for managers of manufacturing companies. Over the past year, there has been a definite decline in companies intending to raise prices on their products. The realization of these intentions was reflected in the dynamics of producer prices, where the average annual PPI fell from about 25% in June 2022 to minus 2.5% in August 2023. Currently, the trends on the side of producer expectations are reversing and the number of companies planning to raise prices is increasing. The situation varies by industry and company size. The strongest expectations of price increases are expressed by small businesses. Of the 22 industries, the preponderance of responses indicating the need to raise prices dominates in 13 industries, while the strongest responses are in the leather and clothing industry, the machinery industry and companies providing services related to machinery installation, maintenance and repair, and the automotive industry. Plans to raise prices in part may anticipate an increase in the cost of doing business in 2024, including, in particular, a higher Social Security contribution of more than 12% compared to the current year.

Similar trends, to escalating inflationary expectations, have been noted among consumers. In a CSO survey in early September, the inflation expectations index rose by more than 3 points for the first time in a year. There was an increase in those expecting prices to rise faster than before, while the percentage of those expecting prices to fall decreased.

It is worth noting that both surveys were conducted before the manipulative reduction in gasoline prices, so they did not affect the opinions expressed by consumers and business representatives.

Basic commodity price indexes are not trending upward for the time being, although declines in food prices have recently slowed down, mainly due to the rise in sugar prices on global exchanges. In the industrial raw material markets, increased price volatility can be expected in the near term due to the renewed outbreak of war in the Middle East.

Source: biec.org