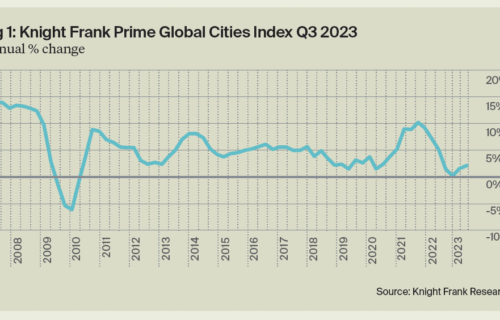

According to an index tracking price changes in the luxury real estate rental market, the Prime Global Cities Index, published quarterly by Knight Frank, luxury real estate prices in 46 cities are rising steadily. At the end of June 2023, the increase was 1.6% and at the end of August this year. 2,1%. The trend of rising prices is a positive sign, indicating returning confidence in future interest rate decisions, especially since in the first quarter of this year luxury property prices recorded a decline for the first time since 2009 (down 0.2%).

Key data:

– The average price increase in the 46 cities tracked by the index was 2.1%.

– 11 cities recorded price declines. There were 14 cities affected by price declines in the previous quarter.

– 63% of cities recorded positive price growth in the last three months, up from 57% in the previous quarter.

– Dubai, which has maintained its leadership position for 8 consecutive quarters, gave way to Manila. There, prices rose 21.2% year-on-year.

– Only two European cities – Madrid and Stockholm – made the top ten. Prices of premium real estate there rose 5.5% and 4.7%, respectively.

The rise in prices confirms that global housing markets are showing signs of stabilization, despite significantly higher financing costs. Continued inflation uncertainty and the risk of rising interest rates are affecting all segments of the housing sector, including luxury real estate, which will eventually lead to a medium-term reduction in the growth rate of these prices.

Despite a relatively modest price increase of 2.1% this quarter, Manila topped the list with a 21.2% year-over-year price increase. Increasing domestic and foreign investment is cited as the reason.

Dubai, where luxury real estate has become 15.9% more expensive in 12 months, fell to second place in the list due to a sharp decline in price growth on a quarterly basis. These grew by 11.6% in Q2 and just 0.7% in Q3.

During the second quarter, Stockholm’s premium real estate market recorded strong price growth. However, at the end of Q3, prices fell sharply by 7.7% q/q. A similar situation is observed in Tokyo, which was second in the ranking, but has now dropped to 29th with a 12% quarter-on-quarter price drop.

American cities dominated the bottom of the table. San Francisco saw prices fall 9.7% and New York City 4%. Investors are showing interest in Miami real estate and there demand contributed to a 0.9% price increase.

With inflation falling and interest rates held stable by central banks, demand for real estate has begun to rise, as seen in the index’s performance. However, these are fragile foundations that only a renewed rise in inflation will be enough to shatter. Stabilization will only be possible once interest rates begin to be cut, which is unlikely before the end of the first half of 2024.