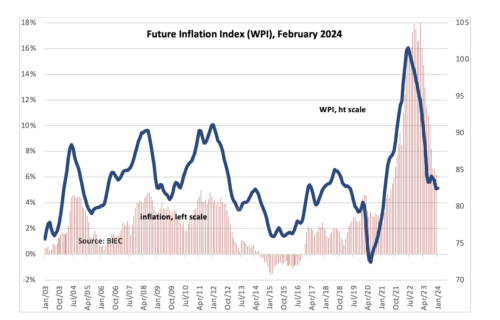

The Future Inflation Index (WPI), which forecasts several months in advance the direction of changes in the prices of consumer goods and services in February 2024, did not change its value compared to last month. Over the past six months, there have been increasingly frequent signals heralding difficulties in further curbing inflation and even signals foreshadowing its periodic rise. The key for the medium-term trend in inflation will be the middle of the year, when it should be known by how much energy prices for households will rise, what about electricity price shields for small and medium-sized enterprises and what about the reduced VAT rate on basic food goods.

Inflation expectations of representatives of manufacturing companies remained at a similar level to last month’s results. Opinions expressing willingness to raise prices in the near future predominate. The smaller the enterprise, the stronger the intentions to raise prices. Among the factors that are the reason for price increases, entrepreneurs mention labour costs in the first place. This factor is indicated by more than 88% of the surveyed managers of companies in the industrial processing sector. As the second factor prompting companies to raise prices, they mention energy and fuel prices (nearly 80% of respondents), while in third place are the prices of components and services (nearly 68% of respondents). All three factors will play a key role in shaping the prices of final goods in the near future. The increase in energy prices will most strongly affect small and medium-sized companies, which have benefited from shielding programmes in recent years; another surge in labour costs will occur in the middle of the year, with the introduction of another increase in the minimum wage; and the increase in the cost of services, especially related to maintenance and repair of machinery, will continue as the machinery and equipment that companies currently have at their disposal ages. From the point of view of the development of business costs and, consequently, inflationary processes, a mitigating influence is the recently recorded decline in the average percentage of capacity utilisation in industry (from around 80% a year ago to 77% at present), which lowers somewhat the cost of doing business and thus reduces upward pressure on prices. Unfortunately, the lower percentage of capacity utilisation is a consequence of the slowdown in industry, rather than higher fleet productivity.

The inflation expectations of household representatives have not changed significantly for three months. Still around 82% of those surveyed expect prices to rise, but the percentage of those who think they will rise faster than before is declining in favour of the group of people who think they will rise more slowly. In the latest survey, the proportion of those expecting prices to stabilise has increased. However, it is small – around 8% of the population of consumers surveyed.

There has been little change in the last two months in the commodity price index published by the IMF. Its level is now around 13% lower than a year ago and the majority of industrial and food raw materials have seen prices fall or stabilise in recent months.

The vast majority of factors currently influencing inflation trends in Poland are of an internal nature. Inflationary impulses related to the war in Ukraine have long since died out, as evidenced, for example, by the return of inflation in the euro area to 2.9%. The main domestic inflationary factors are the continued stimulation of consumption, the monopolisation of many sectors of the economy and above all the energy, fuel and banking sectors, as well as the lack of deregulation of the labour market, which allows a free influx of labour from outside.

Source: BIEC