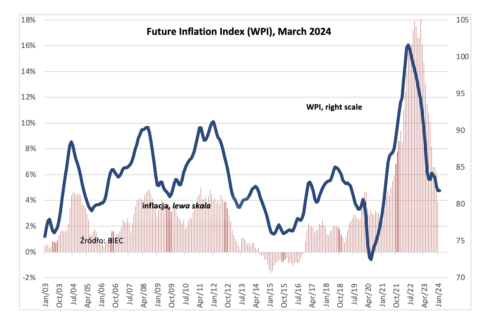

The Future Inflation Index (WPI), which forecasts several months in advance the direction of changes in the prices of consumer goods and services in March 2024, did not change its value compared to last month.

External factors favouring slower price growth are mainly falling commodity prices on global markets, in particular lower energy commodity and food prices. Domestic factors include strong disinflation of PPI producer prices and a slight strengthening of the zloty against the dollar and the euro. The timing of the decision not to extend the zero VAT rate on basic food products seems optimal from the point of view of inflationary processes, due to the global trend of falling food prices, additionally supported by seasonal factors in the coming months. A threat to the disinflation process (apart from the consequences resulting from the way it is reported in terms of annualised price dynamics), remains the demand side. High wage dynamics, not linked to positive productivity developments, the planned doubling of the minimum wage and all benefits related to it for this year, as well as the high and growing share of various types of social benefits in the budget expenditure, may cause a demand-supply imbalance that will lead to a rebound in inflation.

Particularly worrying for future inflation trends is the negative relationship between changes in industrial labour productivity and changes in wages. From the second half of 2021 onwards, labour productivity fell by an average annual rate of almost 10%. At the same time, real wages grew at a rate of more than 8%. This negative relationship between labour productivity and wages occurred for the first time since the early 1990s. Between 1990 and 2020, labour productivity underwent numerous changes to the rhythm of accelerations and decelerations of the overall economy and the investment rate. Wages were subject to similar changes with a lower amplitude. However, during periods of labour productivity growth in industry, the relationship between it and wages was, on average for the whole period, like 1:4, i.e. a 4% increase in labour productivity was accompanied by a 1% increase in wages. The current negative relationship between productivity and wages is a consequence of the low level of investment, especially in new technologies, the shrinking labour force, the monopolisation of many sectors of the economy and the state policy on minimum wages and social benefits.

Inflation expectations of representatives of manufacturing companies have remained unchanged for the past three months, with an approximately 13% advantage of companies planning to raise prices on their products over those intending to reduce prices in the near future. The highest propensity to raise prices is shown by representatives of the metal industry, producers of computers and other electronics and representatives of companies involved in the repair and maintenance of machinery and equipment.

Consumers’ expectations of price formation in the near future have decreased slightly compared to a month ago. The percentage of responses indicating an increase in prices in the near future decreased by around 3 percentage points. This change occurred as a result of a decrease in the group of consumers expecting prices to rise at least at the current rate in favour of consumers expecting prices to fall, which once again shows that some respondents equate falling inflation with falling prices rather than slower price increases.

The commodity price index, published by the IMF, remained unchanged from the previous month’s quotations. The vast majority of raw materials, both industrial and food, are also cheaper than a year ago. The exceptions are precious raw materials, whose prices have gone up by an average of around 7% in the last year, and coffee, tea and cocoa, which have become more expensive by nearly 40% in the last twelve months.

Source: BIEC