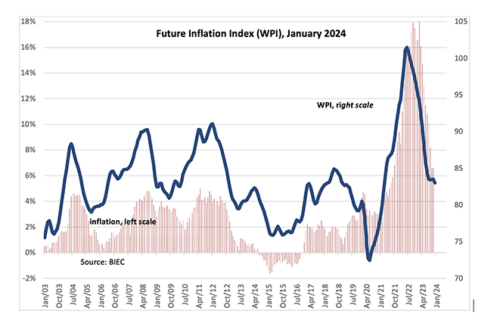

The Future Inflation Index (WPI), which forecasts several months in advance the direction of changes in the prices of consumer goods and services in January 2024, fell by 0.5 points compared to December’s quotations. The end of last year was characterised by the deceleration of the index’s decline and its oscillation around similar values. This was mainly due to a resumption of inflation expectations among consumers and producers. At present, these expectations have stabilised, while the exchange rate of the zloty against the dollar and the euro, as well as the prices of basic raw materials on global markets, are conducive to a reduction in the rate of price increases in the near future. Factors not conducive to a further decline in inflation include a further strong stimulation of consumer demand and an increase in the cost of doing business, especially labour costs.

The inflation expectations of representatives of manufacturing companies remained at a similar level to last month’s results. Currently, the advantage of the percentage of companies planning to raise prices for their products in the near future over the percentage of companies planning reductions does not exceed 13%. This advantage has lasted for three months and is significantly higher than in the summer months of last year. Of the 21 industries surveyed by the CSO, only three are dominated by opinions pointing to the possibility of falling prices. In the remaining industries, opinions indicating an increase prevail. Tendencies to raise prices are most strongly expressed by manufacturers of transport equipment, the pharmaceutical industry, the clothing industry and in the industry providing machine repair, maintenance and installation services. Particularly worrying are the intentions for increases in the latter industry. They are most likely to result from increased demand for these categories of services, and this in turn is a consequence of the significant degree of wear and tear on the machinery stock currently owned by companies and the years-long backlog of investment in the technological equipment of companies.

Inflation expectations of household representatives decreased slightly compared to last month (down by less than 1 percentage point). Still, around 82% of respondents expect prices to rise. There was a slight decline in those who expect prices to rise in the near future at the current rate in favour of a group of respondents who believe they will rise more slowly than before. The index of inflation expectations of Polish consumers is more than twice as high as the average for the European Union as a whole, but in our region, the level of these expectations is elevated in almost all countries. The highest, and significantly higher than for Poland, is in Hungary and Slovenia.

The commodity price index published by the IMF continues to decline. Its level is approximately 14% lower than a year ago and the fall in prices in recent months has affected most industrial raw materials.

The recent strengthening of the zloty against the euro and the dollar not only has a positive impact on the purchase prices of imported raw materials, but also limits the increase in the prices of all imported goods and thus restricts the scope for price increases on similar products manufactured by domestic producers.

Source: BIEC