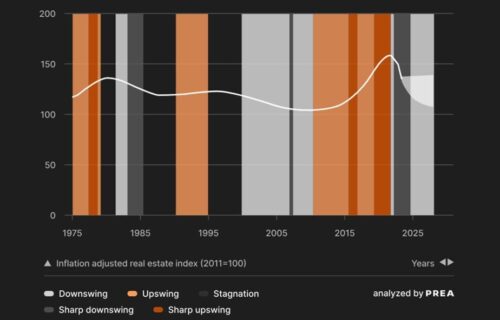

– According to a recent PREA study, the prices for residential real estate in Germany will continue to fall

– Increased financing costs are raising the sales pressure on existing properties

– By the end of 2024, prices are expected to fall back to the level of early 2017

– PREA anticipates a recovery at the earliest by the beginning of 2025

Price corrections in the German housing markets are not yet complete. A recovery is not expected to begin until early 2025 at the earliest. This is confirmed by a study from the technology and real estate company PREA. For the study, analysts examined real estate market cycles in 24 countries from 1975 to 2024 and applied the data to the current situation in the German residential property market.

“Our study shows that current hopes for a reversal in the trend of residential property prices are premature,” says Gabriel Khodzitski, CEO and founder of PREA. “Institutional investors and private buyers would be better off waiting if in doubt, as scientific analysis still confirms significant downward potential.”

Martin Kern, senior market analyst for real estate and energy at the PREA Group: “Although prices for residential properties in Germany have already fallen by 21 percent between the first quarter of 2022 and the third quarter of 2023, the bottom has not yet been reached. The saying ‘Survive until 25’ is likely to become a reality for many market participants.” Several factors support this view.

Firstly, the PREA analysis confirms that there is a positive correlation between the duration and dynamics of upswings and downturns. This means: if property prices have risen sharply over a long period, this was usually followed by a long phase of significantly falling prices. Therefore, the current downturn in the German residential property market is still too short and too mild.

Secondly, the opportunity costs for real estate investment have drastically increased with the turn in interest rates. While real estate as an investment was almost without competition for more than a decade, the residential property market is now competing again with other forms of investment such as stocks and government bonds. This is also why interest in residential properties is expected to be lower in the coming months than in previous years – and prices are expected to fall accordingly.

However, demand for residential properties will not only remain low among investors in the coming months but also among private households looking for a home. For many, homeownership remains unaffordable despite the recent price corrections. According to the “German Real Estate Index” (Greix), all major cities are currently experiencing falling prices. However, a significant portion of the price correction is due to the recent high inflation, which has weakened purchasing power: a euro today is worth significantly less than at the beginning of 2022.

According to PREA, this means that even upper-middle-class households with a monthly income of 5,000 euros or more can only afford a larger existing apartment in the top-7 cities if they spend up to 50% of their monthly net household income on financing. “Newly built apartments are also unaffordable for this group,” says Kern. “As long as even high earners cannot afford property, demand will remain low and prices will have to adjust.”

Furthermore, the supply in the German residential real estate market is likely to increase soon. The reason: With higher interest rates, the costs for refinancing have also risen. By 2025 at the latest, many owners will need to refinance the loans they took out ten years earlier under favorable conditions. Instead of interest rates between 1.2 percent and 1.8 percent, however, they will then face rates between 3.5 percent and 4.5 percent. “For some owners, their interest expenses will therefore triple or quadruple,” says Kern. “Many buyers will not be able to bear such a burden and will be forced to sell their property under pressure. The same applies to investors who need to refinance their current loans. Due to the turn in interest rates, not only have their financing costs increased. At the same time, the value of the mortgaged properties and thus the value of the securities have decreased. This limits their borrowing capacity and reduces their liquidity. Thus, they may be forced to reduce their holdings.”

Given all these factors, PREA expects that the price correction in the German residential real estate market is not yet complete. “We expect that residential property prices will continue to fall at a high rate until the fourth quarter of 2024,” says Kern. “In the scenario we anticipate, prices will fall back to the level of early 2017 by the end of this year.” Compared to the first quarter of 2022, this would correspond to an inflation-adjusted price correction of 25 percent. Afterwards, the market will either enter a recovery phase or the price correction will continue at a slower pace.

However, in many major cities, especially the top 7, the decline in prices may be less severe. A significant reason is the sharp increase in rents in recent years. “Renting is financially sensible only as long as the rental payments are lower than the interest expenses,” says Kern. In all top-7 cities, it is already sometimes cheaper to buy a property for personal use than to rent a new apartment of comparable size and equipment. Martin Kern: “Should rental prices continue to rise to a similar extent as recently, this could again have a positive impact on the demand for home ownership – and thus also on purchase prices.”