The dynamics in the office market in Poland are constantly evolving, influenced by the changing needs of tenants and developers. An analysis of data from the first three quarters of 2023 sheds light on these changes and reveals interesting trends for Q3 2023.

Office market activity: Warsaw and the regions:

In Warsaw, tenant activity in offices is lower than a year earlier, but higher than in 2020 and 2021, the REDD expert points out. Interestingly, in the first three quarters of 2023, nearly 20% fewer office lease transactions were recorded than in the previous year. Nevertheless, the overall volume of rental transactions is higher than in 2020 and 2021.

“Similar trends are observed in regional markets. The total volume of rental transactions in the six main markets outside of Warsaw in the first three quarters of 2023 was lower than in the same period in 2022 (by nearly 22%), but it is still at a higher level than in 2020 and 2021. This trend may be a result of the changing needs of tenants who are adapting offices to new requirements and trends, but it is too early to determine this unequivocally,” says Krzysztof Foks, Head Of Research, REDD.

In Q3 2023, offices were on offer for an average of 386 days, the second lowest since the beginning of 2022. There is now a downward trend, but it is worth noting that the index has experienced some fluctuations in previous periods.

“Analysing the REDD Index for different office sizes, we see that offices up to 500 m² are leasing the fastest. The value drops from 346 days in Q3 2023 to 390 days in Q1 2023. For offices between 500 m² and 1,000 m² and above 1,000 m², the rental time varies more, and in the third quarter, offices in the 500-1,000 m² group were available the longest,” Foks points out.

Office rental rates in Warsaw and the regions:

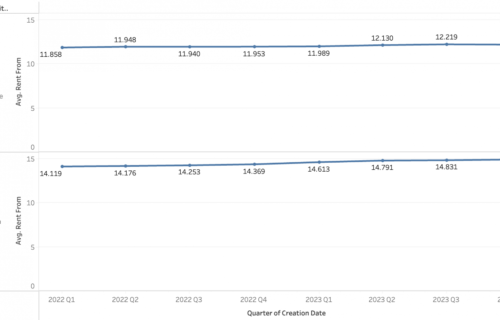

In the capital, offices can be rented for as little as a few euros a month, but modern spaces cost much more. – The highest prices reach over EUR 30/m², while the average rental price in Warsaw is almost EUR 15/m². In regional cities, rental offers tend to be cheaper, oscillating between a few and a dozen EUR/m², with an average rental price of EUR 12.19/m². An interesting trend is that minimum office rental rates have been rising gradually since the beginning of 2022. In Warsaw, they have increased from EUR 14.11/m² to EUR 14.9/m² and in regional cities from EUR 11.86/m² to EUR 12.19/m². The increase in prices has been observed over recent quarters,” the REDD expert calculates.

New office projects in Poland:

After a record number of office projects at the beginning of the decade, a decline in the number of projects under construction is currently being observed. In Warsaw, there is 220,000 m² of office space under construction, and in the regional markets nearly 450,000 m². Projects under construction include The Bridge and Vibe by Ghelamco in Warsaw, Quorum Cavatina in Wrocław, Andersia Silver in Poznań and The Park complex in Kraków (White Star). Recently, new investments have been launched, such as The Form in Warsaw’s Wola district, Towarowa 22 in Warsaw run by Echo Investment and Grundmann Office Park in Katowice.

Analysis of data and trends in the office market in Poland allows us to understand changes in tenants’ preferences, office availability and rental prices. These trends influence developers’ decisions and shape the office market in the country. REDD, is a technology company that is the provider of the largest market database in this part of Europe.