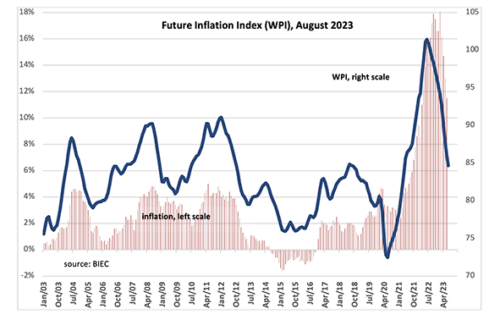

The Future Inflation Index (WPI), which forecasts several months in advance the direction of changes in the prices of consumer goods and services, in August 2023 decreased by 1.3 points from the previous month’s quotation and this was the smallest decline in the last five months. Some of the components of the index have recently started to become pro-inflationary, which may foreshadow a reduction in the disinflation process in the coming months.

The consumer and manufacturing managers’ inflation expectations indices have been declining for many months, although the rate of decline has moderated in the past two months. For the first time since February 2022, the proportion of consumers surveyed expecting prices to rise further has fallen below 80% (78.9% in July 2023), with the proportion expecting prices to rise at the current or faster-than-existing rate shrinking in favour of a group of respondents who think prices will fall or at least not rise in the coming months.

The advantage of traders intending to raise prices over those planning to lower them has significantly decreased.

It now reaches around 5 percentage points compared to more than 26 a year ago. The tendency to reduce prices is dominant among large and medium-sized companies. By industry, the largest price reductions can be expected in the oil processing industry (where prices have risen by nearly 30% over the year to date) and the wood and paper industries. The willingness to raise prices is most often expressed by representatives of clothing companies and food manufacturers. Due to the significant share of food expenditure in the CPI basket (over 27%), further increases in this category of goods may significantly slow down the disinflation process.

The tendency to reduce the growth rate of producer prices (PPI) has been observed for a year and currently the average annual inflation for producers does not exceed 1%, with about 4% decline in prices in manufacturing and nearly 30% increase in gas, electricity and water prices. Again, the upward price dynamics for basic services, without which no company can function, could become the trigger for a renewed inflationary rebound.

As a result of the previous reduction in the scale of production, capacity utilisation is falling in companies. This is usually associated with lower costs of their operation, which reinforces the tendency of entrepreneurs to maintain prices at their current level or even reduce them. However, this process can be counteracted by a significant increase in the price of services related to the operation of machinery and equipment. A clear increase in prices in companies providing repair, overhaul and maintenance services has been observed for more than two years and is a consequence of increased demand for these categories of services. In turn, the increased demand for machinery repair and maintenance is a consequence of years of investment backlogs, resulting in increased failure rates of existing equipment.

Further factors that may contribute to a significant deceleration in the rate of inflation include commodity prices. July and the first days of August saw an increase in the prices of some raw materials. This was particularly true for the prices of selected metals (such as copper) and food raw materials (cereals, dairy products and meat).

Food raw materials became more expensive both as a result of the blockade of Ukrainian grain shipments and also due to the prevailing drought in countries that are significant global producers (Canada, USA, India, China).

Author: www.biec.org