Romania’s real estate transaction volume soared by 131% year-on-year in the first half of 2024, reaching €418 million, marking the highest growth rate in Central and Eastern Europe (CEE). This significant rise places Romania third in the region, following Poland and Czechia, and ahead of Hungary and Slovakia. The retail and industrial sectors were the primary drivers, accounting for 90% of the total volume, while office transactions made up just 4%, according to Cushman & Wakefield Echinox.

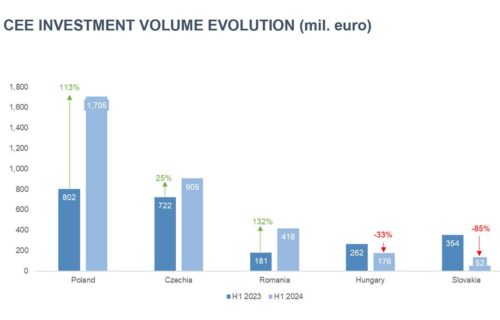

The total transactional volume across the CEE region (including Romania, Poland, Czechia, Hungary, and Slovakia) hit €3.26 billion in H1 2024, a 40% increase compared to H1 2023. Poland saw a 113% rise, and the Czech market grew by 19%. Conversely, Hungary experienced a 33% drop in real estate investment, with Slovakia seeing a 73% decline.

Romania recorded 38 transactions in H1 2024, up from 17 in H1 2023, as reported by the Romania Investment Marketbeat from Cushman & Wakefield Echinox. This has been the most active first half-year since 2017, with expectations for a stronger second half.

Cristi Moga, Head of Capital Markets at Cushman & Wakefield Echinox, stated, “We have seen a resurgence in investor interest in the Romanian real estate market in H1 2024, particularly from existing players. The outlook for the second half remains positive, with more relaxed financing conditions and stabilizing prices. We anticipate significant transactions, especially in the retail and office sectors, with the total 2024 transaction volume likely to reach around €1 billion, a typical annual level for the local market over the past decade.”

In H1 2024, the retail sector held the largest volume share at 47%, followed by industrial (43%), hospitality (6%), and office (4%). The largest transaction was CTP’s acquisition of six industrial and logistics parks from Globalworth (267,900 sq.m GLA) for €168 million, reinforcing CTP’s dominance in this segment. Another major deal was WDP’s purchase of Expo Market Doraly, a 100,000 sq.m retail and wholesale center near Bucharest, for approximately €90 million.

Prime yields remained stable across all segments in H1, with only a slight 10 basis point increase for industrial properties compared to the end of 2023. Yield levels stood at 7.25% for office and shopping center assets and 7.50% for industrial properties.

Source: Cushman & Wakefield Echinox