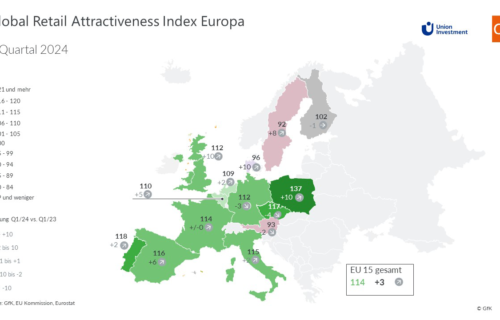

The positive trend in European retail markets is becoming more entrenched. The signs of recovery that emerged in the first quarter of 2023 gained in strength and breadth in Q2 2023. This upward trend then continued in the majority of countries in the first quarter of 2024. Nine of the fifteen European retail markets included in the Global Retail Attractiveness Index (GRAI) compiled by Union Investment and GfK experienced growth over the year. The indicator now stands at 114 points overall, representing a slight increase of three points compared to the previous year. The biggest rises were seen in the UK, Denmark and Poland, with 10 points each, and in Sweden, which added 8 points. Readings declined slightly in the Czech Republic (minus 4 points), Germany (minus 3 points), Austria (minus 2 points) and Finland (minus 1 point).

“Consumer confidence increased in all 15 markets compared to the prior year, with significant double-digit increases in Poland, the UK and Southern European markets. Retail sales were also encouraging. These two factors boosted the EU-15 index to its highest level since 2018,” said Markus Diers, head of Asset Management Retail at Union Investment. Consumer sentiment (91 points) improved by 12 points compared with the first quarter of 2023, while retail sales (138 points) were up 5 points. In contrast, the mood among retailers (95 points) was almost unchanged despite higher sales. The labour market indicator (137 points) was likewise flat year-on-year.

CEE and Southern Europe dominate the top group.

Poland continues to top the country ranking in the EU-15 index with 137 points, an increase of 10 points compared to the previous year. In second and third place are Portugal (118 points) and the Czech Republic (117 points). Joining the top group is Spain with 116 points, followed by Italy and France (115 points and 114 points respectively). Due to weak retail sentiment, Germany comes seventh in the current country ranking (112 points).

“The improvement in the GRAI is a further indication of the turnaround in retail after the pandemic,” said Andreas Löcher, head of Investment Management Operational at Union Investment. “However, we shouldn’t overlook the fact that polarisation of the retail market is continuing apace. Convenience and experience are clear winners of this trend, i.e. local shops on the one hand and best-in-class shopping on the other. Shopping destinations in excellent micro-locations that also benefit from tourism – such as ALEXA in Berlin and Palladium in Prague from our portfolio – remain compelling and will likely attract more investor capital. Outside these two crisis-resistant sub-segments, transformation efforts need to be stepped up in order to stay relevant.”

Performance in overseas regions continues to lag behind.

While European retail markets have found their way out of the crisis, North American markets are underperforming. But it is the Asia-Pacific region in particular that continues to lag significantly behind Europe. The GRAI’s North America index improved slightly by 3 points during the year and stood at an average of 99 points at the end of the first quarter of 2024, while the retail index in Asia-Pacific remained at a subdued 92 points. The gap to the EU retail index thus increased to 22 points.

The slight gain in North America was primarily driven by improved consumer sentiment (plus 15 points). The labour market, meanwhile, adversely impacted the index (minus 9 points). The retail index for Asia-Pacific showed a similar picture of improved consumer sentiment combined with a weak labour market.

The winners in the two overseas regions include South Korea (plus 5 points), the US (plus 3 points) and Japan (plus 2 points). Australia (minus 17 points) and Canada (minus 3 points) experienced the biggest decline over the year. The Canadian retail market is struggling and retained its bottom place in the GRAI’s global country ranking.