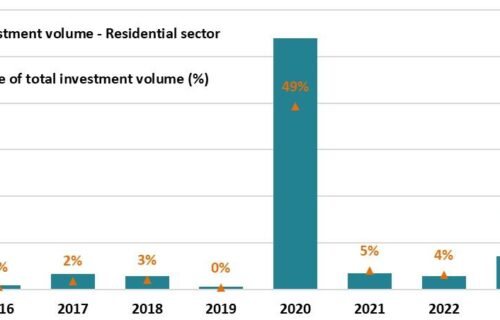

Rental housing has emerged as a significant player in Prague’s real estate investment market, accounting for almost 20% of total investment volumes, according to the latest report from Savills. In the first half of 2024, residential transactions reached EUR 158 million, representing 18% of the total volume. The second quarter alone saw this figure rise to 22%. This marks a sharp increase from historical trends, where residential deals, primarily involving single apartment buildings, rarely exceeded 5%.

Recent transactions include high-profile acquisitions such as the Vysočanský mlýn project, purchased by MINT Residential Fund, Nová Elektra acquired by AFI Europe, and the Prague Archdiocese’s purchase of Rezidence U Šárky, Xplace Hranička/Waltrovka, and Xplace Milovice. These deals reflect the growing interest in rental housing from institutional investors.

Fraser Watson, Head of Investment at Savills, attributes this surge to a shift in the approach of developers. “Due to rising mortgage costs, traditional buyers have retreated from the market, prompting developers to sell entire blocks to institutional investors. While this may result in a slight reduction in overall revenue compared to individual apartment sales, it offers a more straightforward and efficient process for developers,” he explains. Watson also notes that as the “Built To Rent” market gains traction, further changes are expected as residential housing picks up momentum and affordability remains a concern for many potential homeowners.

Vojtěch Wolf, Senior Investment Analyst at Savills, predicts that 2024 will surpass last year’s volumes, making it one of the most successful years for the rental housing sector. “Rental housing has immense growth potential, particularly given the current state of the homeownership market. Investors are increasingly drawn to this sector, and we anticipate sustained activity in the coming year,” says Wolf.

Prague is the epicenter of this boom, with 4,130 modern rental units—properties built or renovated specifically for long-term rental. Since 2021, the capacity for rental housing has grown by 65%, and there are an additional 1,000 rental apartments currently under construction, with over 3,000 more in the planning stages. The sector also includes co-living spaces, private student dormitories, and senior housing, further broadening its scope and appeal to investors.